Vruddhi Engineering Works specializes in providing mechanical splicing solutions to the estate, construction, and infrastructure sectors. They are involved in designing, engineering, and delivering rebar couplers offering a range of services such, as customized rebar couplers, on-site threading services, for the couplers well as trading in threading machines and spare parts.

Vruddhi Engineering Works is committed to offering splicing solutions encompassing design, production, testing, logistics, and rebar threading. The company positions itself as an option, for splicing techniques, in the construction sector.

Vruddhi Engineering Works provides a range of products, such as couplers and Steel Products used in various construction projects, like commercial buildings, steel structures, and roads. The rebar couplers are customized to meet customer specifications and produced by a manufacturer.

By using tactics, like ensuring materials are delivered on time maintaining high-quality standards streamlining logistics managing inventory effectively, and offering prices the company has built connections with its customers. As of March 31 2023, Vruddhi Engineering Works had around 84 clients in the splicing sector. Catered to more than 2 clients, in the steel products trading industry.

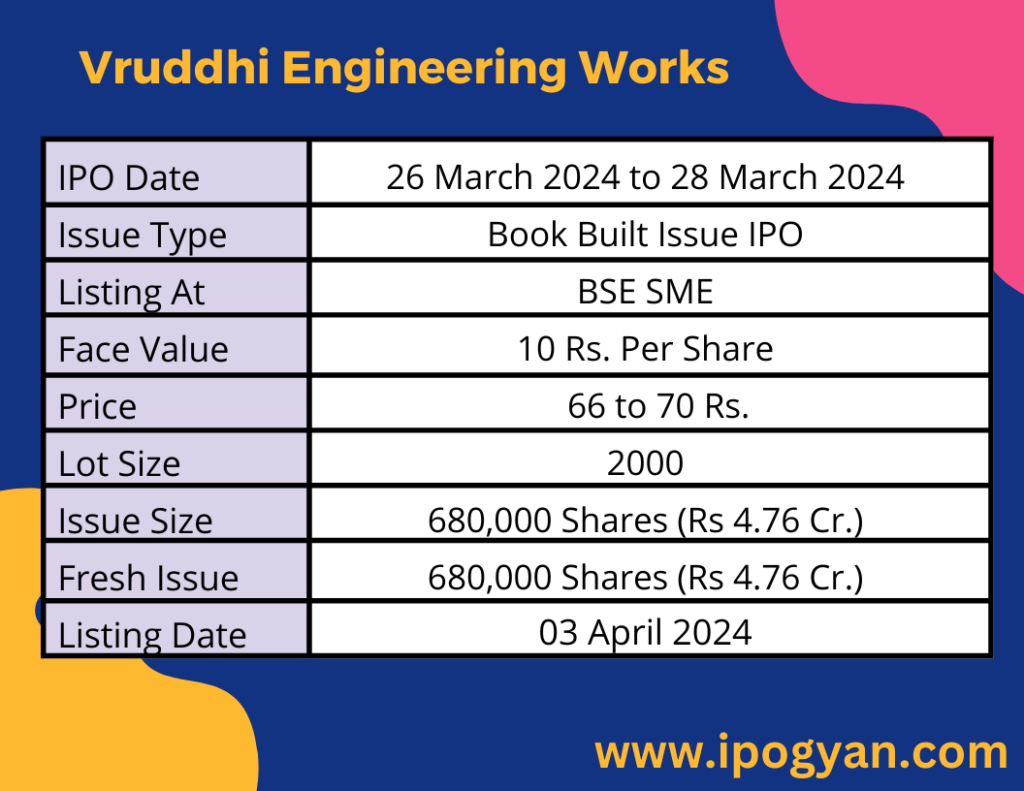

Vruddhi Engineering Works IPO Complete Details:

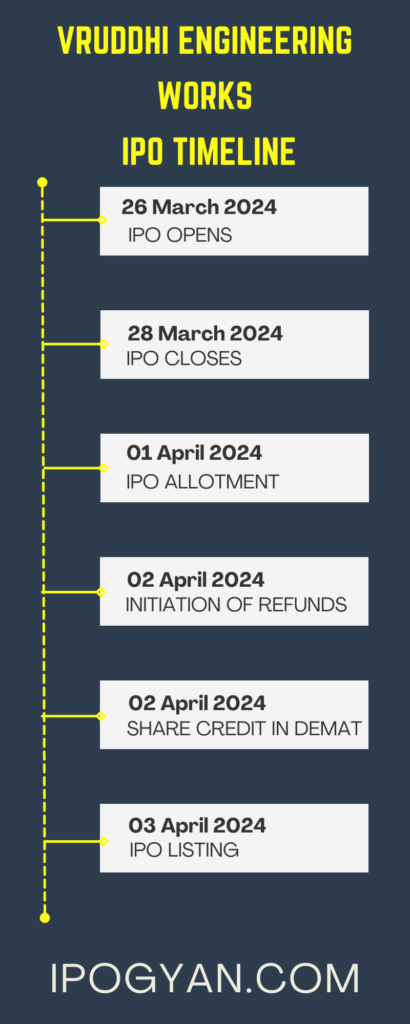

Vruddhi Engineering Works IPO Timetable:

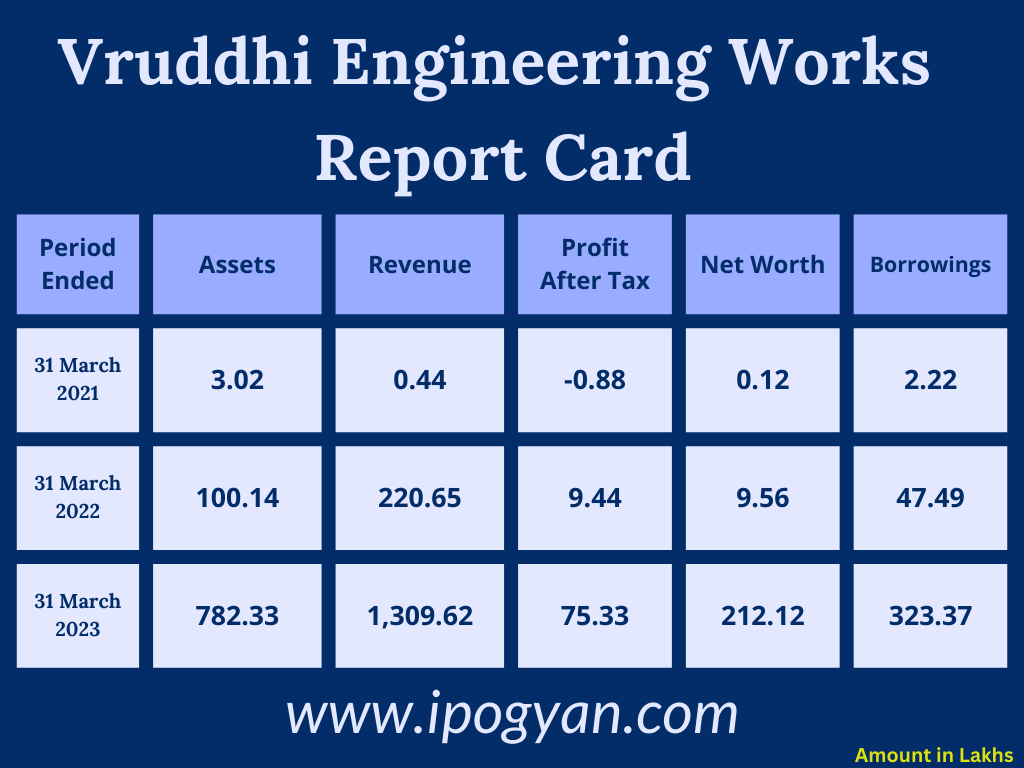

Company Financial Details:

AS OF NOW, the GMP Of “Vruddhi Engineering Works” is Around 00 Rs.

Objects Of Issue:

i. Meeting working capital needs;

ii. Fulfilling general corporate objectives.

Promoters:

- BINDI KUNAL MEHTA

FAQs:

When Vruddhi Engineering Works IPO is Opening?

Vruddhi Engineering Works IPO is Opening on 26 March 2024.

When is the Vruddhi Engineering Works IPO Closing?

Vruddhi Engineering Works IPO is Closing on 28 March 2024.

What is the Issue Size of the Vruddhi Engineering Works IPO?

The IPO Issue Size of Vruddhi Engineering Works is 4.76 Crore.

Price Band of Vruddhi Engineering Works IPO?

The price Band of Vruddhi Engineering Works IPO is 66 to 70 rupees per share.

What is the minimum investment for a Vruddhi Engineering Works IPO?

The minimum investment for the Vruddhi Engineering Works IPO is 140,000 Rupees.

Allotment Date of Vruddhi Engineering Works IPO?

The Allotment of Vruddhi Engineering Works IPO is on 01 April 2024.

Listing Date of Vruddhi Engineering Works IPO?

The Listing Of Vruddhi Engineering Works is Scheduled on 03 April 2024.

One Should Apply for Vruddhi Engineering Work IPO or Not?

Will Update Soon..

How to apply for Vruddhi Engineering Work IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Vruddhi Engineering Work IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Vruddhi Engineering Work IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Vruddhi Engineering Work IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Vruddhi Engineering Work IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Vruddhi Engineering Work IPO from the list ——–> Click on Vruddhi Engineering Work IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Vruddhi Engineering Work?

Fedex Securities Pvt Limited is the Lead Manager of Vruddhi Engineering Work.

Where To Check the Allotment of Vruddhi Engineering Work IPO?

The allotment status for the Vruddhi Engineering Work IPO will be accessible on the Bigshare Services Pvt Ltd Website.

Vruddhi Engineering Work IPO is going to be listed at?

Vruddhi Engineering Work IPO is going to be listed at BSE SME.

What is the Lot Size of the Vruddhi Engineering Work IPO?

The lot size of the Vruddhi Engineering Work IPO is 2000 Shares.

What is the P/E Ratio of the Vruddhi Engineering Work?

The P/E Ratio of the Vruddhi Engineering Work is 17.13.

What is the EPS of the Vruddhi Engineering Work?

The EPS of the Vruddhi Engineering Work is 4.09.

What is the ROE of the Vruddhi Engineering Work?

The ROE of Vruddhi Engineering Work is 16.20%.

What is the ROCE of the Vruddhi Engineering Work?

The ROCE of the Vruddhi Engineering Work is 15.53%.