Unihealth Consultancy Limited operates as a healthcare service provider and is headquartered in Mumbai, India. Now Company has an operational presence in various countries across the African Continent. Unihealth Consultancy Limited operates around many business segments such as Medical Centres, Hospitals, Consultancy Services, Distribution of Pharmaceutical and medical Consumable Products, and Medical Value Travel.

Under the brand name ‘UMC Hospitals,’ the company manages a combined total of 200 operational hospital beds across two multi-speciality facilities. Specifically, UMC Victoria Hospital in Kampala, Uganda, boasts a bed strength of 120 beds, while UMC Zhahir Hospital in Kano, Nigeria, offers 80 beds. Additionally, Unihealth Consultancy Limited operates ‘Unihealth Medical Centre,’ which is dedicated to providing dialysis services and is located in Mwanza, Tanzania.

Presently, the company is engaged in providing Project Management Consultancy Services for the establishment of a Health City with over 300 beds in Undri, Pune, Maharashtra, India. For this Project, Unihealth Consultancy Limited has collaborated with PHRC Lifespaces Organization, the company which is actively involved in other healthcare consultancy projects in Kenya and Angola.

Unihealth Consultancy Limited is also actively engaged in the export and distribution of pharmaceutical and medical consumable products in Uganda, Tanzania, and Nigeria. They serve as a distributor for many pharmaceutical and consumable manufacturing companies based in India which are operating in different African countries.

The diverse business verticals of Unihealth Consultancy Limited have successfully established their presence across multiple regions within the African continent. Although the company’s registered office is located in India, it has expanded its operations to encompass India, Uganda, Nigeria & Tanzania, Kenya, Zimbabwe & Angola, and Ethiopia, Mozambique & DR Congo.

Unihealth Consultancy Limited’s unique aspect is its business model capability to leverage the presence of its Medical Centres and Hospitals to unlock growth potential and maximize revenue and profitability.

In addition, the Consultancy Services vertical offers the company the power to look into options for alliances and growth of its hospital network under the ‘UMC Hospitals’ name, whether through equity alliances or operations and management contracts. This unique an smart approach helps Unihealth Consultancy Limited’s growth opportunities and also helps to generate revenues and profits as a standalone business unit.

The Unihealth Medical Centres Network and UMC Hospitals serve as the essential infrastructure for promoting the Medical Value Travel vertical, by which the company gets help for its continued existence, growth, revenue generation, and profitability. Additionally, it makes it possible to run on-site OPD and surgical camps in association with several foreign healthcare organizations.

Unihealth Consultancy Limited IPO Complete Details:

Unihealth Consultancy Limited IPO Timetable:

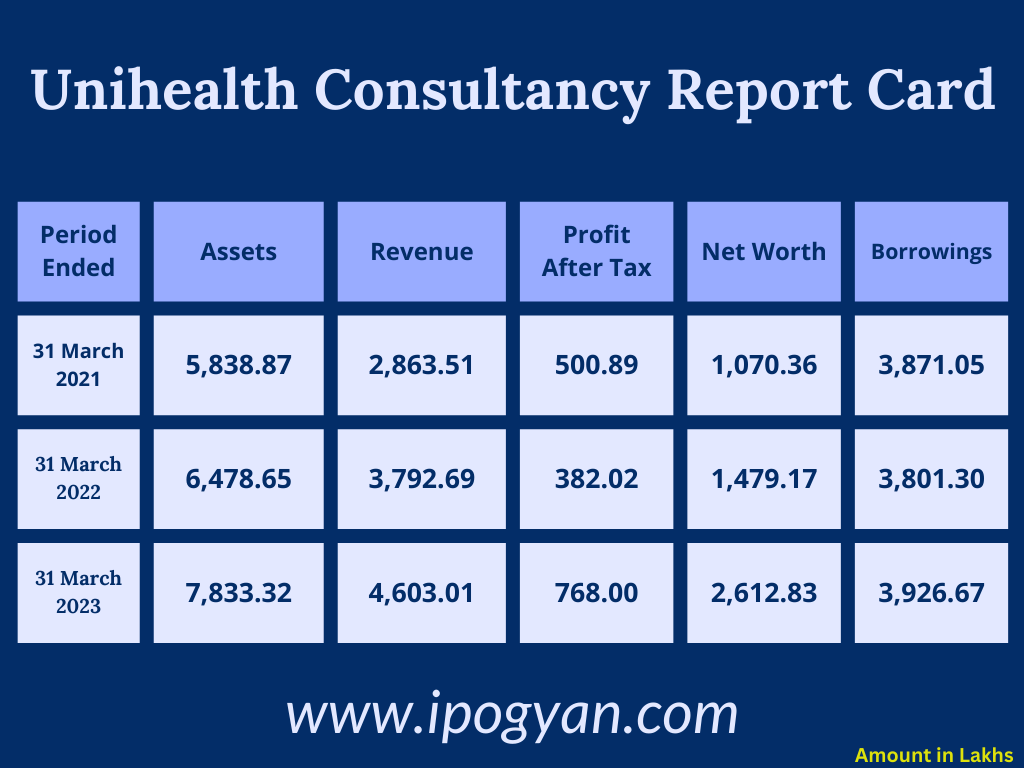

Company Financial Details:

AS OF NOW, the GMP OF Unihealth Consultancy Limited is Around 20 Rs.

Objects Of Issue:

- Consideration involves an investment in the joint venture, Victoria Hospital Limited (VHL) in Kampala, Uganda, to fund its expansion and working capital needs.

- There is also a focus on investing in the joint venture, UMC Global Health Limited (UMCGHL) in Nigeria, to support its expansion plans.

- Contemplation extends to an investment in the subsidiary, Biohealth Limited (BL) in Tanzania, for its expansion requirements.

- Funds are under consideration for general corporate purposes.

Promoters:

Dr. Akshay Parmar, aged 36, has serves as the Promoter, Chairperson, and Managing Director of the company since April 27, 2023. He has an MBBS degree from K. J. Somaiya Medical College, Mumbai, and completed a Certificate Program in ‘Value Creating Financial Strategies’ at ISB Hyderabad in 2021. Dr. Parmar received the ‘Business Icon of India’ award in 2021.

Dr. Anurag Shah, also aged 36, has been the Promoter and Executive Director since February 26, 2010. He holds an MBBS degree from K. J. Somaiya Medical College, Mumbai. He played a very important role in founding the company. Dr. Anurag Shah manages business development, and branding, and is the Managing Director of the Ugandan joint venture, Victoria Hospital Limited.

FAQs:

Who is Unihealth Consultancy Limited Company?

Unihealth Consultancy Limited operates as a healthcare service provider and is headquartered in Mumbai, India.

When Unihealth Consultancy Limited’s IPO is Opening?

Unihealth Consultancy Limited IPO is Opening on 08 September 2023(Friday).

When Unihealth Consultancy Limited IPO is Closing?

Unihealth Consultancy Limited IPO is Closing on 12 September 2023(Tuesday).

What is the IPO Issue Size of Unihealth Consultancy Limited?

The IPO Issue Size of Unihealth Consultancy Limited is 56.55 Crore.

Price Band of Unihealth Consultancy Limited IPO?

Unihealth Consultancy Limited IPO’s Price Band is 126 to 132 Rupees Per Share.

What is the minimum investment for Unihealth Consultancy Limited IPO?

The minimum investment for Unihealth Consultancy Limited IPO is 132,000 Rupees.

Allotment Date of Unihealth Consultancy Limited IPO?

The Allotment of Unihealth Consultancy Limited IPO is on 15 September 2023(Friday).

Listing Date of Unihealth Consultancy Limited IPO?

The Listing Of Unihealth Consultancy Limited is Scheduled on 21 September 2023(Thursday).

One Should Apply Unihealth Consultancy Limited IPO or Not?

Will Update soon!

How to apply for Unihealth Consultancy Limited IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Unihealth Consultancy Limited IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Unihealth Consultancy Limited IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Unihealth Consultancy Limited IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Unihealth Consultancy Limited IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Unihealth Consultancy Limited IPO from the list ——–> Click on IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Unihealth Consultancy Limited IPO’s Lead Manager?

Unistone Capital Pvt Ltd is the Lead Manager of Unihealth Consultancy Limited IPO.

Where To Check the Allotment of Unihealth Consultancy Limited IPO?

The allotment status for the Unihealth Consultancy IPO will be accessible on the Bigshare Services Pvt Ltd Website.

Also Read:

EMS Limited IPO Review, Date, Price, GMP

Kahan Packaging Limited IPO Review, Date, Price, GMP

Pramara Promotions Limited IPO Review, Date, Price, GMP

Saroja Pharma Industries India Limited IPO Review, Date, Price, GMP

Basilic Fly Studio Limited IPO Review, Date, Price, GMP

CPS Shapers Limited IPO Review, Date, Price, GMP

Ratnaveer Precision Engineering Limited IPO Review, Date, Price, GMP