Oneclick Logistics India Incorporated in 2017 operates as an integrated logistics services and solutions provider, offering a wide range of services. These services can be broadly categorized as follows:

- Non-vessel operating common carrier (“NVOCC”).

- Ocean and air freight forwarding (“Freight Forwarding”).

- Bulk cargo handling (“Bulk Cargo”).

- Custom clearance, facilitated through arrangements with third parties holding valid Custom House Agent’s Licenses.

- Allied logistics and transportation services.

The Company provides customers complete solution as an integrated end-to-end logistics service provider which eliminates the need to operate with several service providers at different moments along the logistics chain. Their services encompass container handling, clearing and forwarding, customs clearance, brake bulk handling, and brokerage, claims recovery (including customs and insurance), warehousing, distribution, supply chain management, port and terminal operations, and container freight station operations.

Oneclick Logistics India operates on an asset-light strategy, outsourcing its infrastructure needs to third-party suppliers. Due to its integrated service approach, the firm takes advantage of a variety of business possibilities presented by its customers, increasing revenue and profitability.

Oneclick Logistics India primarily provides its services in India, with a special focus on assisting importers who are bringing in products from nations like China, Europe, Singapore, and Malaysia. Through agency partnerships, they are present in these nations and can provide their services to areas where they do not have a physical presence. These agency relationships also make it easier for partners who don’t have a physical presence in India to find new business prospects there.

The company is active in all of India’s major ports, including privately owned ports like Nhava Sheva, Mundra, Delhi ICD, Pipavav, Chennai, and ICD Ahmedabad. As of the date of the Draft Prospectus, the company has served 627 customers. For the period ending March 31, 2023, their NVOCC, Freight Forwarding (FCL), Freight Forwarding (Air), and Bulk Cargo verticals have handled 7424 throughput TEUs, 28481 cubic meters, 25 brake bulk shipments, and 650 custom clearances.

The company has a diverse client base that includes companies from the automotive and heavy engineering, telecom, food and agricultural, fast-moving consumer goods (“FMCG”), paint, and other industries in India. They have mastered end-to-end pickup, clearance, and delivery services for all kinds of heavy and extra-dimensional cargo throughout the years.

Oneclick Logistics India IPO Complete Details:

Oneclick Logistics India IPO Timetable:

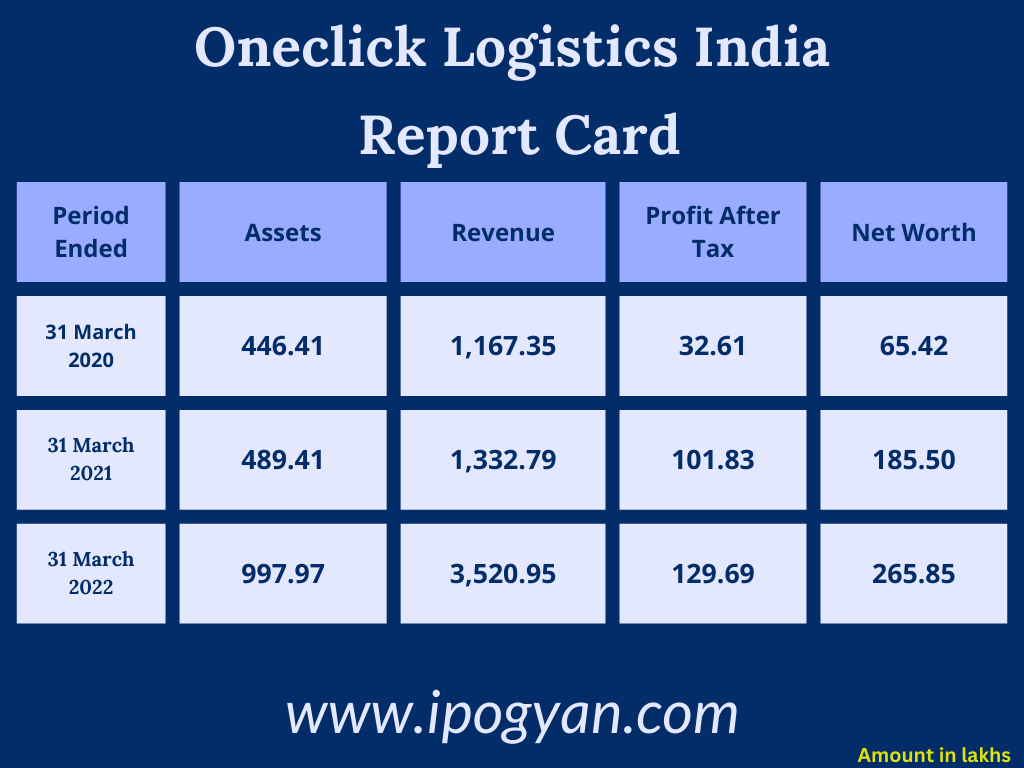

Company Financial Details:

AS OF NOW, the GMP OF Oneclick Logistics India is Around 45 Rs.

Objects Of Issue:

- Fulfilling additional needs for operational funds; and

- Addressing general corporate objectives.

Promoters:

Mahesh Liladhar Bhanushali:

- Position: Managing Director and Chairman on the board of the Company.

- Education: Completed a post-graduate diploma in foreign trade from the World Trade Center Mumbai in 2009.

- Experience: Associated with the Company since its incorporation and possesses over 5 years of experience in the logistics industry.

Rajan Shivram Mote:

- Position: Whole-Time Director and Chief Financial Officer on the Board of the Company.

- Education: Holds a bachelor of arts degree in sociology and political science from the University of Mumbai.

- Experience: Associated with the Company since its incorporation and has over 5 years of experience in the logistics industry.

FAQs:

When Oneclick Logistics India’s IPO is Opening?

Oneclick Logistics India IPO is Opening on 27 September 2023(Tuesday).

When Oneclick Logistics India IPO is Closing?

Oneclick Logistics India IPO is Closing on 03 October 2023(Tuesday).

What is the IPO Issue Size of Oneclick Logistics India?

The IPO Issue Size of Oneclick Logistics India is 9.91 Crore.

Price Band of Oneclick Logistics India IPO?

The price Band of Oneclick Logistics India IPO is 99 rupees per share.

What is the minimum investment for Oneclick Logistics India IPO?

The minimum investment for Oneclick Logistics India IPO is 118,800 Rupees.

Allotment Date of Oneclick Logistics India IPO?

The Allotment of Oneclick Logistics India IPO is on 06 October 2023(Friday).

Listing Date of Oneclick Logistics India IPO?

The Listing Of Oneclick Logistics India is Scheduled on 11 October 2023(Wednesday).

One Should Apply Oneclick Logistics India IPO or Not?

Can be applied for listing gains.

How to apply for Oneclick Logistics India IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Oneclick Logistics India IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Oneclick Logistics India IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Oneclick Logistics India IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Oneclick Logistics India IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Oneclick Logistics India IPO from the list ——–> Click on Oneclick Logistics India IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Oneclick Logistics India IPO’s Lead Manager?

Fedex Securities Private Limited is the Lead Manager of Oneclick Logistics India.

Where To Check the Allotment of Oneclick Logistics India IPO?

The allotment status for the Oneclick Logistics India IPO will be accessible on the Bigshare Services Pvt Ltd Website.

Oneclick Logistics India IPO is going to Listing at?

Oneclick Logistics India IPO is going to be listed at NSE SME

What is the Lot Size of Oneclick Logistics India IPO?

The lot size of Oneclick Logistics India IPO is 1200 Shares.

Read More:

City Crops Agro Limited IPO Review, Date, Price, GMP

Sunita Tools Limited IPO Review, Date, Price, GMP

Goyal Salt Limited IPO Review, Date, Price, GMP

Newjaisa Technologies Limited IPO Review, Date, Price, GMP

JSW Infrastructure Limited IPO Review, Date, Price, GMP

Saakshi Medtech and Panels Limited IPO Review, Date, Price, GMP