Valiant Laboratories Incorporated in 1980 is a pharmaceutical company with a focus on manufacturing Active Pharmaceutical Ingredients (APIs) and Bulk Drugs. The manufacture of paracetamol is their core area of expertise. Fundamental ingredients utilized in the production of final dosage forms and pharmaceutical formulations are APIs and bulk drugs.

The World Health Organisation (WHO) recommends paracetamol, also known technically as para-hydroxyacetanilide (C8H9NO2), as the principal treatment for a number of pain conditions. Paracetamol can be used to treat a variety of conditions, such as fever, colds, backaches, muscular pains, arthritis, headaches, and muscle aches. According to the specifications set out by its clients, Valiant Laboratories manufactures paracetamol in a variety of grades, including IP/BP/EP/USP, in accordance with pharmacopeia standards.

Within the Indian pharmaceutical API industry, Valiant Laboratories holds a notable position as the third-largest globally in terms of volume, trailing behind China and Italy. Approximately 35 percent of APIs and intermediaries produced in India are exported, while the remaining products are supplied to the domestic market, including captive consumption by large formulation companies.

Valiant Laboratories holds certificates of good manufacturing practices (GMP) for the manufacture and sale of bulk drugs/API and is ISO 9001:2015 certified. A dedicated quality control team diligently monitors the entire manufacturing process, from the initial testing of incoming raw materials to the final product before packaging.

Located within the Tarapur Industrial Area facility is an in-house Research and Development (R&D) infrastructure, equipped with an analytical laboratory and resources for developmental activities related to existing products. Research and development, legal compliance, quality control, and continual process improvement are all given the highest priority by Valiant Laboratories.

Through its wholly owned subsidiary, Valiant Laboratories intends to undertake a greenfield project at Saykha Industrial Area, Bharuch, Gujarat. This facility would cover an area of about 57,766 square meters and will be specially dedicated to the manufacturing of specialty chemicals such as ketene and diketene derivatives.

Notably, one of these products, acetic anhydride, plays a critical role as a raw material in the Paracetamol manufacturing process. This business venture will support backward integration, operational effectiveness, and affordable pricing. These types of Specialty chemicals are frequently used in a variety of industries, including:

1)Agrochemicals

2)Pharmaceutical intermediates

3)Dyes,

4)Pigments

5)Food, and

6)Fragrances

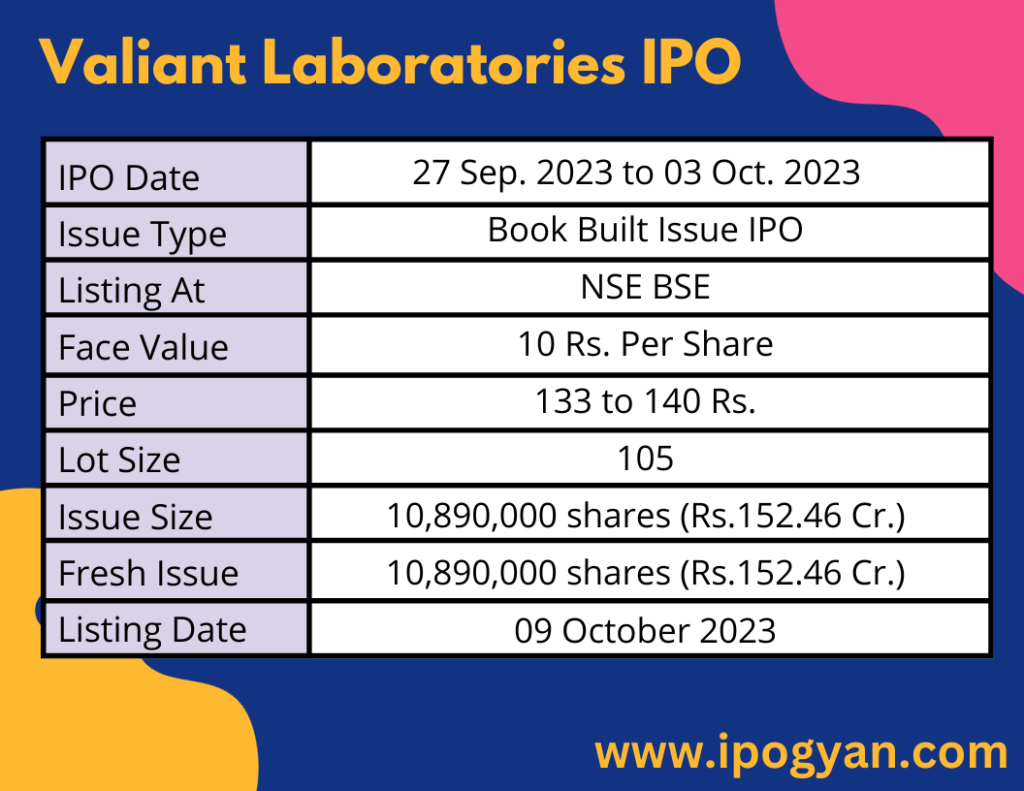

Valiant Laboratories IPO Complete Details:

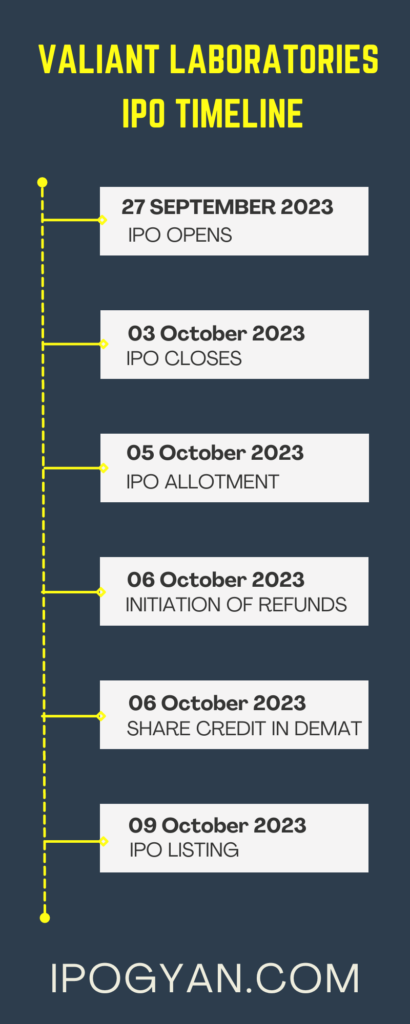

Valiant Laboratories IPO Timetable:

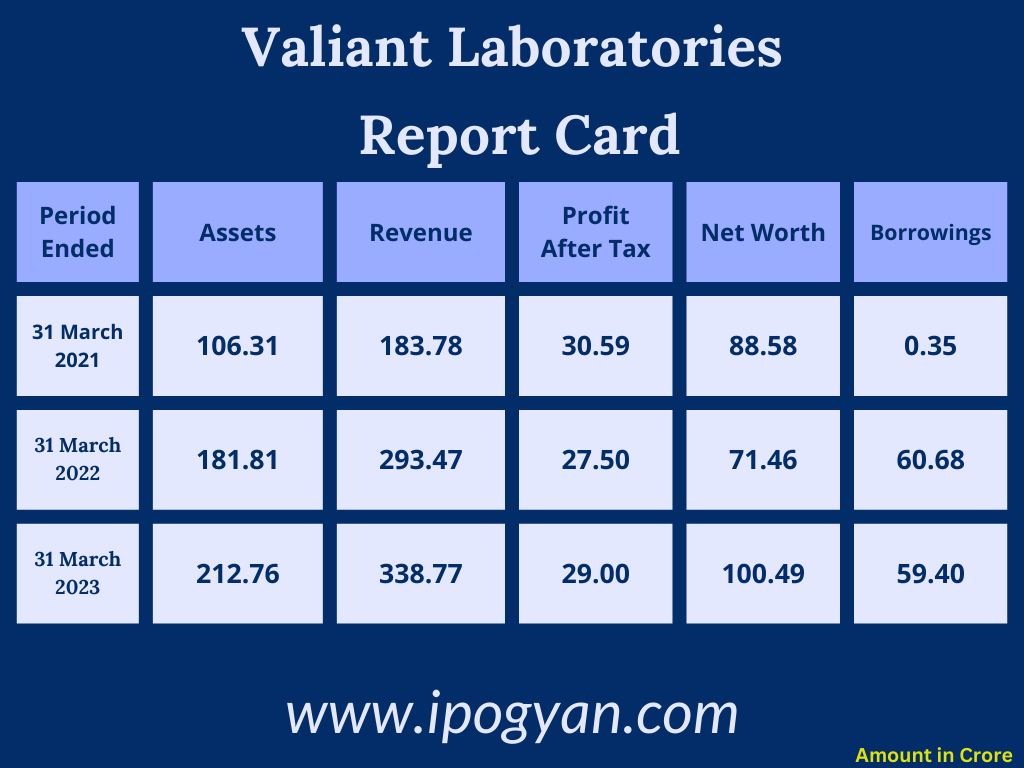

Company Financial Details:

AS OF NOW, the GMP OF Valiant Laboratories is Around 22 Rs.

Objects Of Issue:

The company intends to make the following investments:

- Investment in our wholly-owned subsidiary, Valiant Advanced Sciences Private Limited (VASPL), to partially finance its capital expenditure needs associated with the establishment of a manufacturing facility dedicated to specialty chemicals. This facility will be located at Saykha Industrial Area in Bharuch, Gujarat, and is referred to as the “Proposed Facility.”

- Investment in VASPL to provide financial support for its working capital requirements.

- Utilization of funds for general corporate purposes.

Promoters:

1) Shantilal Shivji Vora

- Age: 71 years

- Position: Non-Executive Director of the Company.

- Experience: Associated with the Company since 1998 (as a partner of M/s. Bharat Chemicals) and is currently serving as a Non-Executive Director.

2) Dhanvallabh Ventures LLP (DVL)

FAQs:

When Valiant Laboratories IPO is Opening?

Valiant Laboratories IPO is Opening on 27 September 2023(Tuesday).

When Valiant Laboratories IPO is Closing?

Valiant Laboratories IPO is Closing on 03 October 2023(Tuesday).

What is the IPO Issue Size of Valiant Laboratories?

The IPO Issue Size of Valiant Laboratories is 152.46 Crore.

Price Band of Valiant Laboratories IPO?

The price Band of Valiant Laboratories IPO is 133 to 140 rupees per share.

What is the minimum investment for Valiant Laboratories IPO?

The minimum investment for Valiant Laboratories IPO is 14,700 Rupees.

Allotment Date of Valiant Laboratories IPO?

The Allotment of Valiant Laboratories IPO is on 05 October 2023(Thursday).

Listing Date of Valiant Laboratories IPO?

The Listing Of Valiant Laboratories is Scheduled on 09 October 2023(Monday).

One Should Apply Valiant Laboratories IPO or Not?

Avoid

How to apply for Valiant Laboratories IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Valiant Laboratories IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Valiant Laboratories IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Valiant Laboratories IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Valiant Laboratories IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Valiant Laboratories IPO from the list ——–> Click on Valiant Laboratories IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Valiant Laboratories IPO’s Lead Manager?

Unistone Capital Private Limited is the Lead Manager of Valiant Laboratories.

Where To Check the Allotment of Valiant Laboratories IPO?

The allotment status for the Valiant Laboratories IPO will be accessible on the Link Intime India Private Ltd Website.

Valiant Laboratories IPO is going to Listed at?

Valiant Laboratories IPO is going to be listed at NSE and BSE

What is the Lot Size of Valiant Laboratories IPO?

The lot size of Valiant Laboratories IPO is 105 Shares.

What is the P/E Ratio of Valiant Laboratories IPO?

P/E Ratio of Valiant Laboratories IPO is 15.71.

What is the EPS of Valiant Laboratories IPO?

EPS of Valiant Laboratories IPO is 8.91.

What is the ROE of Valiant Laboratories IPO?

The ROE of Valiant Laboratories IPO is 33.73%.

What is the ROCE of Valiant Laboratories IPO?

The ROCE of Valiant Laboratories IPO is 22.76%.

Read More:

Oneclick Logistics India IPO Review, Date, Price, GMP

City Crops Agro Limited IPO Review, Date, Price, GMP

Sunita Tools Limited IPO Review, Date, Price, GMP

Goyal Salt Limited IPO Review, Date, Price, GMP