Saroja Pharma Industries India Limited’s Initial Public Offering (IPO), commencing on 31 August 2023, marks a transformative step for the pharmaceutical and healthcare sector. Today we will discuss about company’s business model, important tentative dates of IPO, important details, and the company’s financial details.

Saroja Pharma Industries India Limited’s primary mission is to be excellent in chemical trading by making partnerships with the leading pharmaceutical companies in India and around the world. Saroja Pharma Industries main focus is to deliver very cost-effective products for human and veterinary Medicine. Saroja Pharma Industries India Limited traded Pharma API, Pharma Intermediates, Chemicals, and Solvents, which are parts of pharmaceutical goods for use by humans and veterinary.

Saroja Pharma Industries India Limited’s strategy involved manufacturing products based on clients’ specifications. Initial samples were provided by suppliers, subject to client testing and approval. Upon confirmation, the specified products were manufactured and dispatched within India or internationally. This strategy helps to contribute significantly to providing cost-effective solutions, in the end, products for both human and veterinary medicine.

Saroja Pharma Industries India Limited is also engaged in importing and exporting specialty chemicals for supply to the end users. This includes the necessity for customized specialty chemicals that can easily meet the specific needs of different clients located in both domestic and international markets.

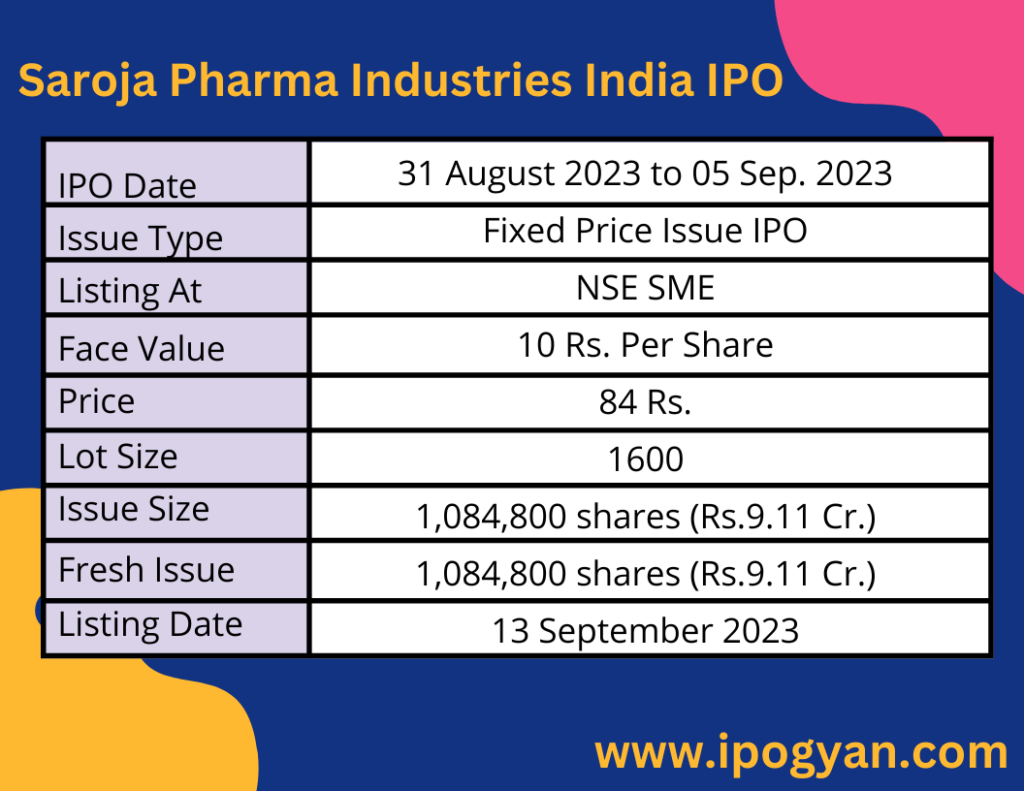

Saroja Pharma Industries India Limited IPO Complete Details:

Saroja Pharma Industries India Limited IPO Timetable:

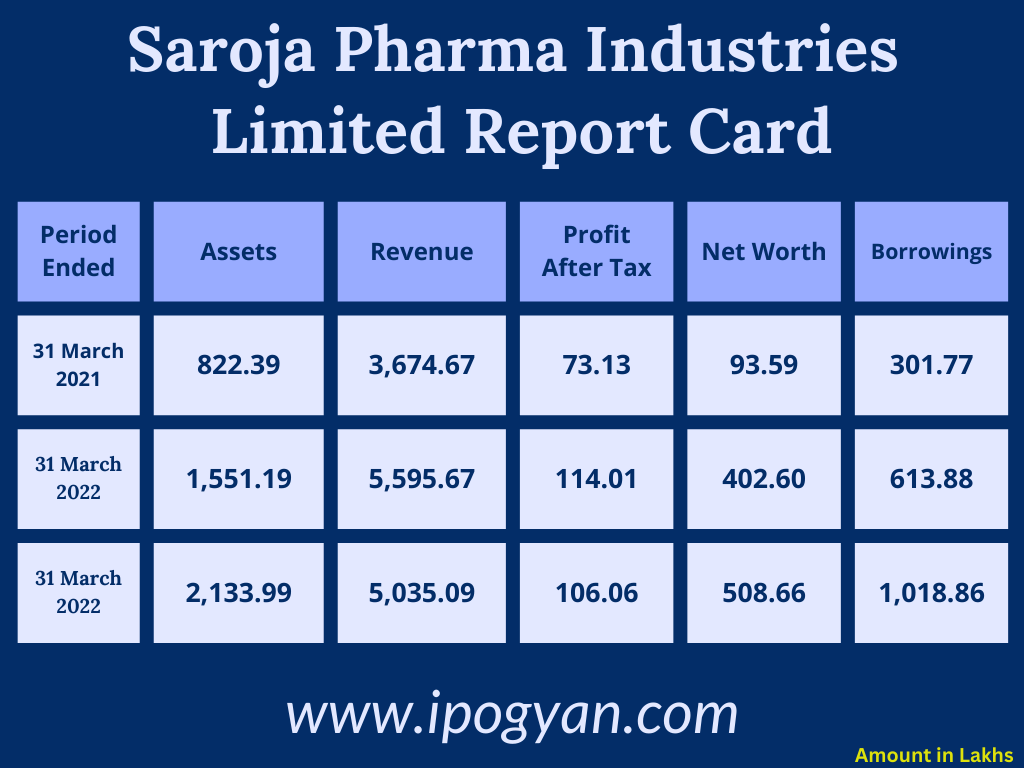

Company Financial Details:

AS OF NOW, the GMP OF Saroja Pharma Industries India Limited is Around Rs.

Object Of Issue:

- Establishing a Manufacturing Facility: Company’s primary objectives of the IPO proceeds is to initiate the establishment of a state-of-the-art manufacturing unit.

- Clearing Unsecured Loan Obligations: Another key utilization of the funds raised through the IPO is to repay existing unsecured loans.

- Covering Public Issue Expenditures: The proceeds from the IPO will also be allocated to cover the expenses associated with the public issue.

Promoters Of Saroja Pharma Industries India Limited :

The promoters of Saroja Pharma Industries India Limited are Mr. Biju Gopinathan Nair and Mr. Manish Dasharath Kamble.

Mr. Biju Gopinathan Nair, aged 52, serves as the Chairman and Managing Director. With 28 years of experience in the chemical sector, he specializes in leadership, team development, and managing complicated supply chains. He is in charge of worldwide and domestic sales and marketing, providing considerable business experience from his time at Lanxess Private Limited and as a chemical consultant. Mr. Biju Gopinathan Nair is in charge of worldwide and domestic sales and marketing, drawing on his experience at Lanxess Private Limited and as a chemical consultant.

Mr. Manish Dasharath Kamble, aged 32, holds the position of Whole Time Director with a focus on Finance and Accounting. With 11 years of experience, he completed his CA internship and actively participated in Bank Audits and Statutory Audits. He later became the General Manager (Finance and Cost Accounting) at Vivacious Pharmatex Private Limited.

Both Mr. Biju Gopinathan Nair and Mr. Manish Dasharath Kamble play key roles as promoters of the company.

FAQs:

Who is Saroja Pharma Industries India Company?

Saroja Pharma Industries main focus is to deliver very cost-effective products for human and veterinary Medicine.

When Saroja Pharma Industries India IPO is Opening?

Saroja Pharma Industries India IPO is Opening on 31 August 2023(Thursday).

When Saroja Pharma Industries India IPO is Closing?

Saroja Pharma Industries India IPO is Closing on 05 September 2023(Tuesday).

What is the IPO Issue Size of Saroja Pharma Industries India?

Saroja Pharma Industries India IPO issue Size is 9.11 Crore.

Price Band of Saraja Pharma Industries India IPO?

Saraja Pharma Industries India IPO is Fixed Price IPO so the price is 84 Rupees per Share.

What is the minimum investment for Saroja Pharma Industries India IPO?

The minimum investment for Saroja Pharma Industries India IPO is 134,400 Rupees.

Allotment Date of Saroja Pharma Industries India IPO?

Allotment of Saroja Pharma Industries India IPO will take place on 08 September 2023.

Listing Date of Saroja Pharma Industries India IPO?

The listing of Saroja Pharma Industries India will take place on 13 September 2023.

How to apply for Saroja Pharma Industries India IPO through Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find the IPO you want to Apply ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Saroja Pharma Industries India IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find the IPO you want to Apply ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Saroja Pharma Industries India IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find the IPO you want to Apply ——–> Click on IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>

Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

One Should Apply Saroja Pharma Industries India IPO or Not?

Retailers Can Avoid To Apply This IPO as there is High Risk and Low Reward.

What is the P/E Ratio of Saroja Pharma Industries India?

The P/E Ratio of Saroja Pharma Industries India is 23.27

What is the Earning Per Share(EPS) of Saroja Pharma Industries India?

The earning Per Share(EPS) of Saroja Pharma Industries India is around 03.61

Conclusion:

Retails Can Avoid this IPO as Many Other Good SME IPOs are in the pipeline and IPOs can give good returns.

Also Read:

Basilic Fly Studio Limited IPO Review, Date, Price, GMP

CPS Shapers Limited IPO Review, Date, Price, GMP

Ratnaveer Precision Engineering Limited IPO Review, Date, Price, GMP