Canarys Automations, founded in 1991, is a leading provider of IT solutions with over three decades of industry expertise. The company supports businesses with digital transformation by offering them a comprehensive set of software solutions in areas like:

1) Digitalization,

2) Modernization,

3) Automation, and

4) Intelligence.

Canarys Automations operates in two main verticals:

- Technology Solutions: Under this vertical company provides a wide range of technology solutions, including consulting services in areas such as digitalization, modernization, cloudification, automation, transformation, and intelligence. DevOps Consulting (Azure, GitHub, Atlassian, GitLab, etc.), Cloud Consulting (Azure, AWS, GCP), Digital Enterprise Solutions using SAP, MS Dynamics 365, RPA, Digital Applications, and Mobility Solutions are among their specialties.

- Water Resource Management Solutions: Canarys Automations provides automation solutions aimed at modernizing irrigation, enhancing water conservation, improving water use efficiency, conducting turnkey flood risk assessments and mitigation, implementing cloud-based water utilization process automation for water sharing in rivers and canals, and deploying SCADA gate control systems.

Canarys Automations serves a diverse range of industry sectors such as:

1) BFSI,

2) Retail,

3) Healthcare,

4) Pharmaceutical,

5) Manufacturing,

6) Insurance, and more.

Canarys Automations main focus is on digital transformation which allows the company to improve customer experience and optimize their operations which helps to preserve competitive advantage.Canarys Automations commitment towards quality has helped them to gain recognition from a wide range of clients, partners, and OEMs.

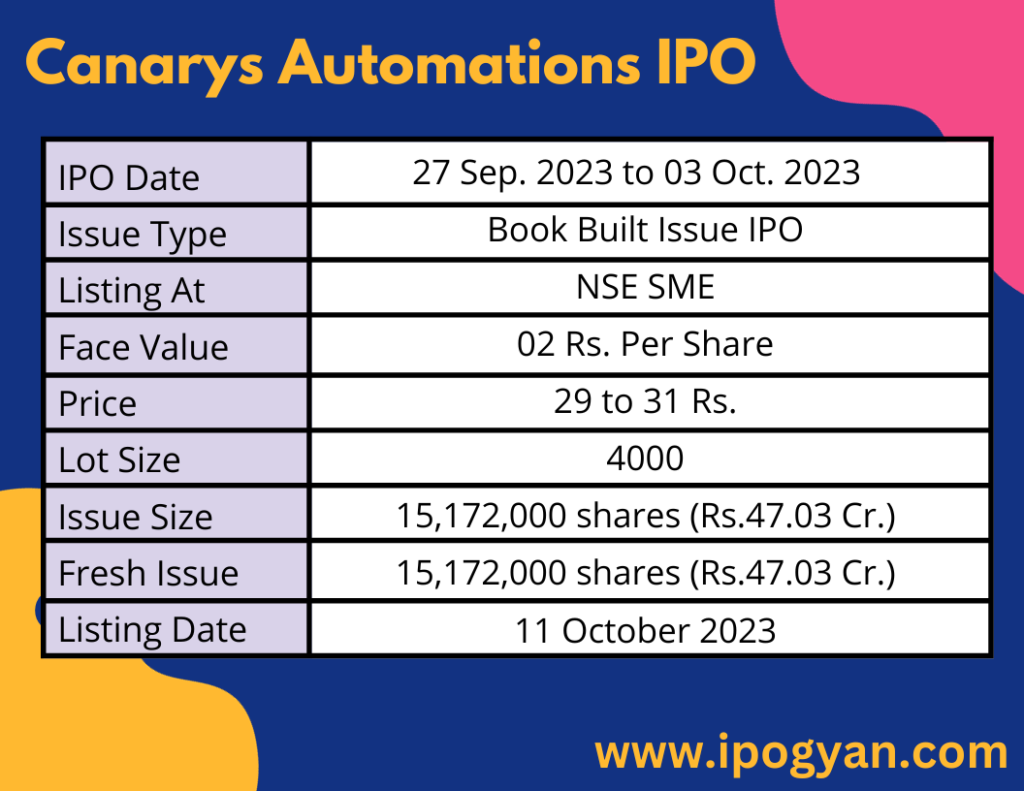

Canarys Automations IPO Complete Details:

Canarys Automations IPO Timetable:

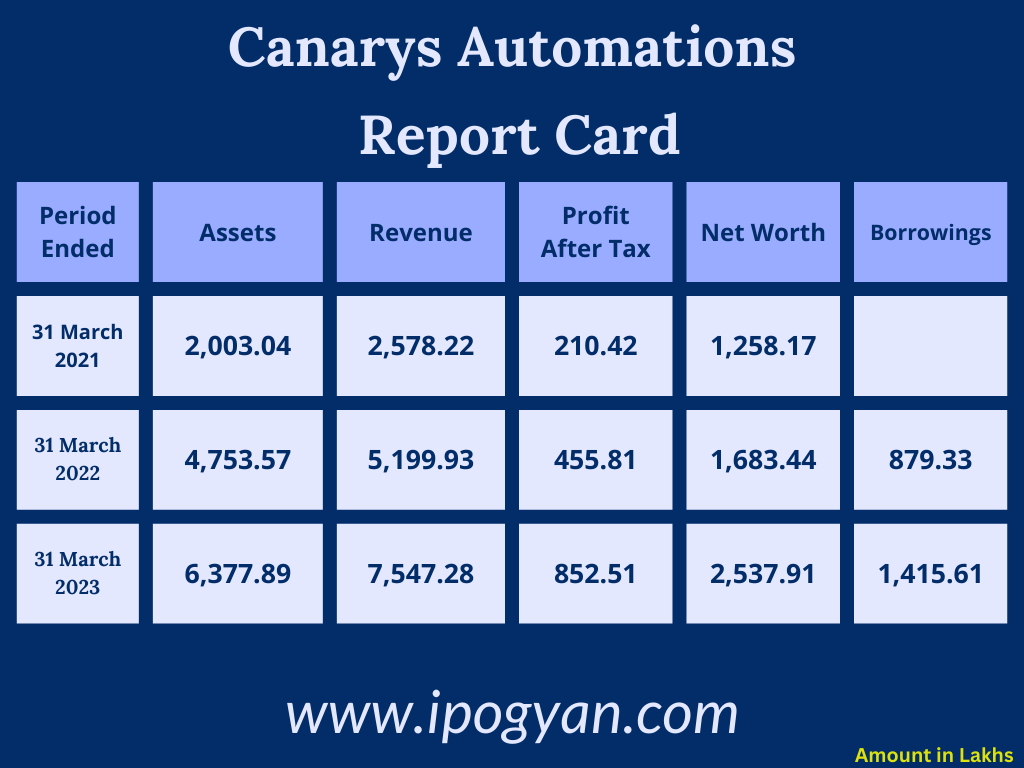

Company Financial Details:

AS OF NOW, the GMP OF Canarys Automations is Around 05 Rs.

Objects Of Issue:

- Financing the expenses associated with the development of solutions for digital transformation and the management of water resources.

- Establishing a new delivery center, including the necessary infrastructure, and enhancing the current facilities.

- Meeting the working capital needs of our company.

- Supporting general corporate activities.

Promoters:

Mr. Metikurke Ramaswamy Raman Subbarao:

- Position: Chairman and Managing Director of the Company.

- Qualification: Bachelor of Engineering in Electronics from B. M. S. College of Engineering, Bengaluru, Karnataka.

- Experience: More than 32 years in Software development.

Mr. Danavadi Krishnamurthy Arun:

- Position: Whole-time Director of the Company.

- Qualification: Bachelor of Engineering in Mechanical from Gulbarga University.

- Experience: More than 32 years in the IT Industry, working on different technology domains, managing production & testing, deployment of IEEE -488 based equipment.

Mr. Raghu Chandrashekhariah:

- Position: Whole-time Director and Chief Financial Officer of the Company.

- Qualification: Bachelor of Engineering in Electronics and Communications from the University of Mysore.

- Experience: More than 31 years in Business Development, Customer and Talent acquisition.

Mr. Sheshadri Srinivas Yedavanahalli:

- Position: Executive Director and CEO of the Company.

- Qualification: Master’s degree in Business Administration from Indian Institute of Technology, Bombay and Washington University in St.Louis.

- Experience: More than 20 years in strategy setting, leadership, and business transformation.

Mr. Pushparaj Shetty:

- Position: Executive Director of the Company.

- Qualification: Bachelor’s degree in Engineering in Industrial Production from the University of Mysore and a Post Graduate Degree in Management Sciences from Shri Dharmasthala Manjunatheshwara-Institute for Management Development, Mysore.

- Experience: More than 24 years in Water Resource Business, including positive relationships with top water managers, Bid and Contract management, and leading the Water Resource Business of the Company.

Mr. Nagaraju Vineeth:

- Position: Promoter of the Company.

- Qualification: Bachelor’s degree in Engineering in Computer Science and Engineering from Bangalore University.

- Career: Started as a director in the Company on March 19, 1999, and resigned on September 30, 2016, accumulating 24 years of experience.

FAQs:

When Canarys Automations IPO is Opening?

Canarys Automations IPO is Opening on 27 September 2023(Tuesday).

When Canarys Automations IPO is Closing?

Canarys Automations IPO is Closing on 03 October 2023(Tuesday).

What is the IPO Issue Size of Canarys Automations?

The IPO Issue Size of Canarys Automations is 47.03 Crore.

Price Band of Canarys Automations IPO?

The price Band of Canarys Automations IPO is 29 to 31 rupees per share.

What is the minimum investment for Canarys Automations IPO?

The minimum investment for Canarys Automations IPO is 124,000 Rupees.

Allotment Date of Canarys Automations IPO?

The Allotment of Canarys Automations IPO is on 06 October 2023(Friday).

Listing Date of Canarys Automations IPO?

The Listing Of Canarys Automations is Scheduled on 11 October 2023(Wednesday).

One Should Apply Canarys Automations IPO or Not?

Can Avoid

How to apply for Canarys Automations IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Canarys Automations IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Canarys Automations IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Canarys Automations IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Canarys Automations IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Canarys Automations IPO from the list ——–> Click on Canarys Automations IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Canarys Automations IPO’s Lead Manager?

Indorient Financial Services Ltd is the Lead Manager of Canarys Automations.

Where To Check the Allotment of Canarys Automations IPO?

The allotment status for the Canarys Automations IPO will be accessible on the Link Intime India Private Ltd Website.

Canarys Automations IPO is going to Listed at?

Canarys Automations IPO is going to be listed at NSE SME

What is the Lot Size of Canarys Automations IPO?

The lot size of Canarys Automations IPO is 4000 Shares.

What is the EPS of Canarys Automations IPO?

The EPS of Canarys Automations IPO is 4.29.